The USDA Loan program, differs from all other loan programs, based on the requirements for a minimum quantity and history of “tradelines” on the credit report. To start off with, a tradeline is a credit account that appears on a credit report that documents the repayment history of a liability, such as a credit card, car loan, student loan, installment loan, etc. These items that appear on the credit report are known as “traditional” tradelines.

There is also what is known as a “non-traditional” tradeline, which are items that establish a normal monthly repayment obligation, that don’t appear on the credit report. This includes the following payment types: rent, utility, insurance, child care providers, school tuition, local store credit cards that don’t appear on credit, medical payment on uninsured portion of medical bill, internet/cell phone service payment, personal loan from a non-family member with written repayment terms, documented 12-month history of savings and regular deposits, etc.

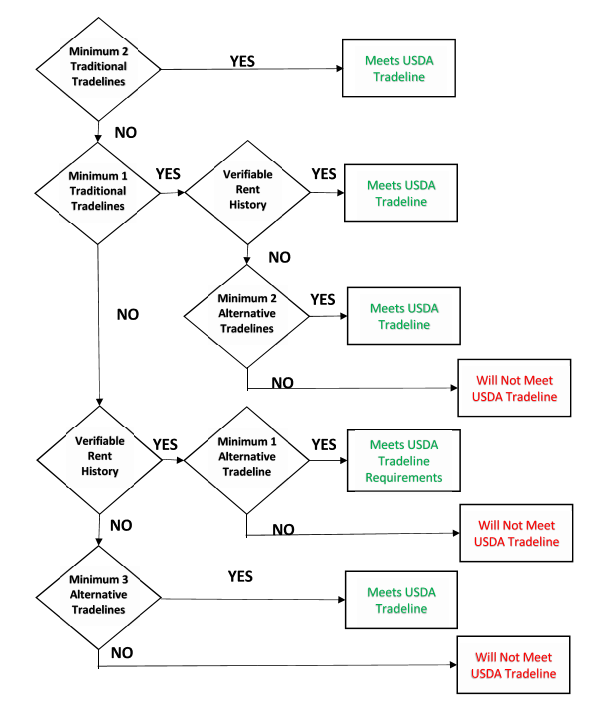

Unlike other loan programs, which provide a loan approval based on an underwriting decision, without regards to any analysis of the credit report, the USDA Loan program will analyze the quantity and history of traditional tradelines appearing on the credit report, regardless of the underwriting findings. The credit report must document a minimum of two traditional tradelines, which can come from open or closed accounts, that have a positive payment history for a minimum of the most recent 12-month period of time. In lieu of having the two traditional tradelines, an analysis is required based on rent history and documenting non-traditional tradelines. Note, student loans only count if there is a repayment history.

To help establish is you have the required tradeline requirements reference the below USDA Tradeline Decision Tree.

To learn more about the Maryland USDA Guaranteed Loan program please call (410) 567-0994.